Banks That Practice Fractional Reserve Banking Are Able to

Goblinko 34 1 year ago. A bank maintains a fraction of the money it has promised in reserve in the hope that it will be able to.

Solved Fractional Reserve Banking Means That Select One Chegg Com

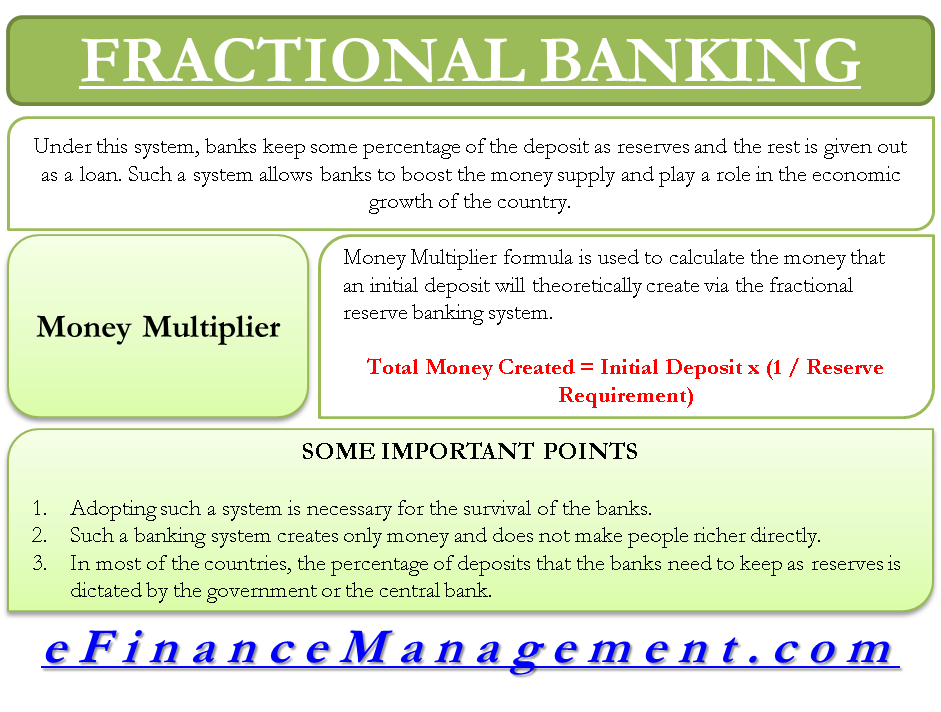

Fractional-reserve banking is a system that allows banks to keep only a portion of customer deposits on hand while lending out the rest.

. The amount that the bank has to keep as cash reserves is determined by the reserve ratio ie. Fractional-reserve banking or FRB is a banking regime in which banks accept base money from customers in return for demand claims on the same amount without maintaining enough reserves of base money to redeem all of the claims at any one time. Banks that practice fractional reserve banking are able to.

Return all of their deposited cash at any time d. Fractional-reserve banking is the system of banking operating in almost all countries worldwide under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve and are at liberty to lend the remainder to borrowers. Lend most of the money they hold as depositsD.

Banks that practice fractional reserve banking are able to a. This system allows more money to circulate in the economy. Nevertheless fractional reserve banking is an accepted business practice that is in use at banks worldwide.

Return all of their deposited cash at any time. Change the interest rates on loans for any reason. Fractional Reserve Banking allows a bank to loan all of the money on deposit except a small fraction which it must keep in reserve.

Lend most of the money they hold as deposits c. Provide financial services to customers at no costC. Article Sources Investopedia requires writers to use primary sources to support their work.

Change the interest rates on loans for any reason b. Change the interest rates on loans for any reasonB. To quote Forbes Its certainly true that banks could maintain 100 of funds deposited but if so they wouldnt be banks.

Provide financial services to customers at no cost. Current banking laws in most countries require that only a fraction of all deposits be kept as a reserve and the bank is free to lend out the remainder. For example if the reserve fraction is 10 a deposit of ten pounds enables the bank to lend ninety pounds to a new borrower ie.

Just did it on A pex. Banks that practice fractional reserve banking are able to. Return all of their deposited cash at any time.

Fractional Reserve Banking is the practice by which a bank accepts deposits and is required to hold only a fraction of its deposits in cash reserves. Lend most of the money they hold as deposits. 100 less 10 kept as reserve thereby increasing the amount of money in circulation.

Bank reserves are held as cash in the bank or as balances in the banks account at. Critics of the system argue that it creates the danger of a bank run where there would not be enough money to meet withdrawal requests. After the bank has made a loan it may then through a complex system of deposits involving a commercial bank may then make a loan on the assets represented by the first loan with the same a small percentage.

Luda 366 1 year ago. You might be interested in. Reserve requirement that is set by the Federal Reserve.

Banks that practice fractional reserve banking are able toA. Fractional reserve banking is often defended by the argument that the system is the very nature of banks. Lend most of the money they hold as deposits.

2 on a question.

Fractional Banking Meaning Importance And Money Multiplier

Solved In A Fractional Reserve Banking System Banks O Must Chegg Com

Solved Banks That Practice Fractional Reserve Banking Are Chegg Com

Comments

Post a Comment